Privatizing ATB is Long Overdue and Compelling

Roger Straathof

Source: Aberhart Foundation. n.d. “Albertans investing in Alberta 1938-1998.”

Introduction

It has been 82 years since Alberta Treasury Branches (ATB) was established by the government of Alberta in 1938, with a mandate to ensure access to financing during the Great Depression and drought, which had devastated the province’s early agricultural economic foundation. It has been 26 years since the Flynn report (Flynn1994), commissioned by Jim Dinning Treasurer in the Klein government, undertook a fundamental review of ATB. The recommendations included guiding principles to put ATB on a solid financial and independent foundation, serving Albertans by competing with other banks on a cost-conscious and self-financing basis. However, its most profound recommendation, to privatize ATB once it had sufficiently rebuilt its capital base, has gone unrealized.

Research and Findings

This is by no means the first study to conclude that privatization of ATB is not only desirable but also in line with full-cycle ownership precedents established by the Alberta government through its involvement in the telephone and energy industries. Earlier studies include the aforementioned Flynn report and the 2011 study by Frank Atkins, an associate professor of economics at the University of Calgary (Atkins 2011). For this Capstone, I had the benefit of segmented information by province more recently provided through the Bank of Canada (BoC 2020), the federally chartered banks in their annual reports and public accountability statements, and through the Canadian Bankers Association (CBA 2018).

Much has changed since 1938. Alberta is a strong contributor to the Canadian economy with the third-largest provincial GDP. Much has also changed in the banking world, now driven by technology and innovation, and a strong federal regulatory regime which has helped to make our banking system the envy of the world. The federally chartered banks have become a major source of credit in Alberta providing some 80 percent of all loans, with 39 percent of their funding sourced from elsewhere through large national and international banking networks.

Currently, fully 89 percent of loans in Alberta are provided by ATB’s competitors, including other home-grown institutions, national banks, federal institutions, and foreign banks. These competitors have continued to fund Albertans and their businesses through economic cycles, as they have demonstrated since the late 2014 oil price collapse and the ensuing economic downturn.

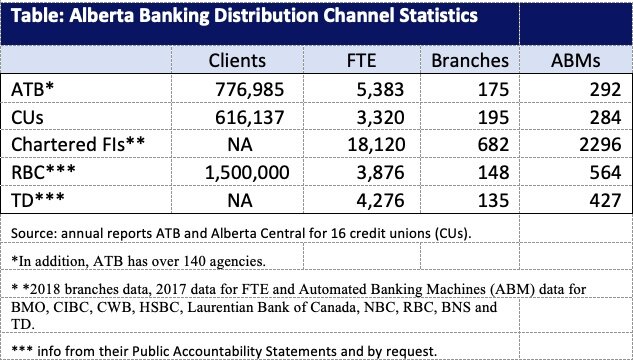

Albertans are well served through a robust banking distribution channel network among the multitude of banking actors. With respect to rural Alberta, the credit unions, along with national banks, are active competitors not only through physical locations supported by mobile bankers who visit customers’ homes and businesses but also serve clients through expanding internet banking capabilities.

Despite competition, ATB seems unable to serve Albertans in a cost-conscious and self-financing basis, while still enjoying government protection and regulatory advantages. It continues to struggle with above-average industry loan losses and inefficiencies, and the ongoing need for additional capital support from the province with little or no return to taxpayers.

Conclusion

After 82 years what has not fundamentally changed with the times is the ownership and oversight of ATB by the government of Alberta, with the province continuing to guarantee ATB’s deposits and funding liabilities. This provides a financial and regulatory advantage over its private-sector competitors. The reluctance to privatize may stem from ATB’s original mandate, to provide access to financing for Albertans, and rural areas in particular, and to support economic growth. However, we now have a thriving local membership-based credit union system which also had its origins in 1938 through the government of Alberta credit union legislation. Alberta’s 16 credit unions (Servus being the largest) serve almost as many clients as ATB and they finance their growth and member distributions from their retained earnings. Canadian Western Bank, with its head office in Edmonton, has grown into a well-run regional bank with major operations in Alberta, BC, and Ontario, providing diverse services across regions.

In fact, as ATB grows, taxpayers are increasingly exposed to liability – a liability that increases as ATB works to expand and crowd out rural competition. Its more liberal lending practices may lead to Albertans and businesses overextending themselves with increased vulnerability to Alberta’s economic downturns.

The time to act on the Flynn report’s recommendation to privatize ATB is long overdue and compelling. Alberta has a track record of successfully privatizing companies like Alberta Government Telephones and Alberta Energy Company. Privatization would ensure that ATB face the rigours of competition, thus forcing it to operate on a sound and sustainable basis. ATB has a large footprint and a solid brand across the province, one that it can leverage in a competitive market. Given the current downturn, and rapidly growing provincial debt and deficit, the time has come for the government of Alberta to realize the funds that would come through the sale of ATB, which has $4.1 billion in equity and $4.4 billion in wholesale notes issued by the government of Alberta on behalf of ATB, and redeploy those funds at a critical time. Perhaps towards some of the economic growth prospects recently announced in the government’s “Alberta Recovery Plan.”

Roger Straathof

About the Author: Roger Straathof is a Master of Public Policy candidate 2020 of the School of Public Policy, University of Calgary. He was fortunate to have worked in banking for some 35 years when the industry experienced profound change and having the opportunity to work with public sector clients, both in Canada and abroad. Roger has always been intrigued about how public policy is being developed and implemented by various levels of government. The topic of ATB as the only bank (still) owned by a provincial government in Canada allowed him to apply his professional background through the lens of academic research and public policy developments in Alberta concerning access to banking since the Great Depression.

For more visit: https://calgaryherald.com/opinion/columnists/opinion-is-it-time-to-sell-off-crown-corporation-atb-financial